How To Get A House Loan With Bad Credit

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Having bad credit makes it harder to get a mortgage. A low credit score makes you look riskier to lenders; it suggests you might be financially unstable or unwilling to repay your debts.

A poor score, however, can also simply be the result of not knowing how the scoring process works or having gone through a brief rough patch that required you to take on debt.

If you think you're ready for homeownership despite your bad credit, here's what you need to know:

- What counts as a bad credit score?

- Credit score needed to get a mortgage

- What having bad credit means for your mortgage rate

- How to get a mortgage with bad credit

What counts as a bad credit score?

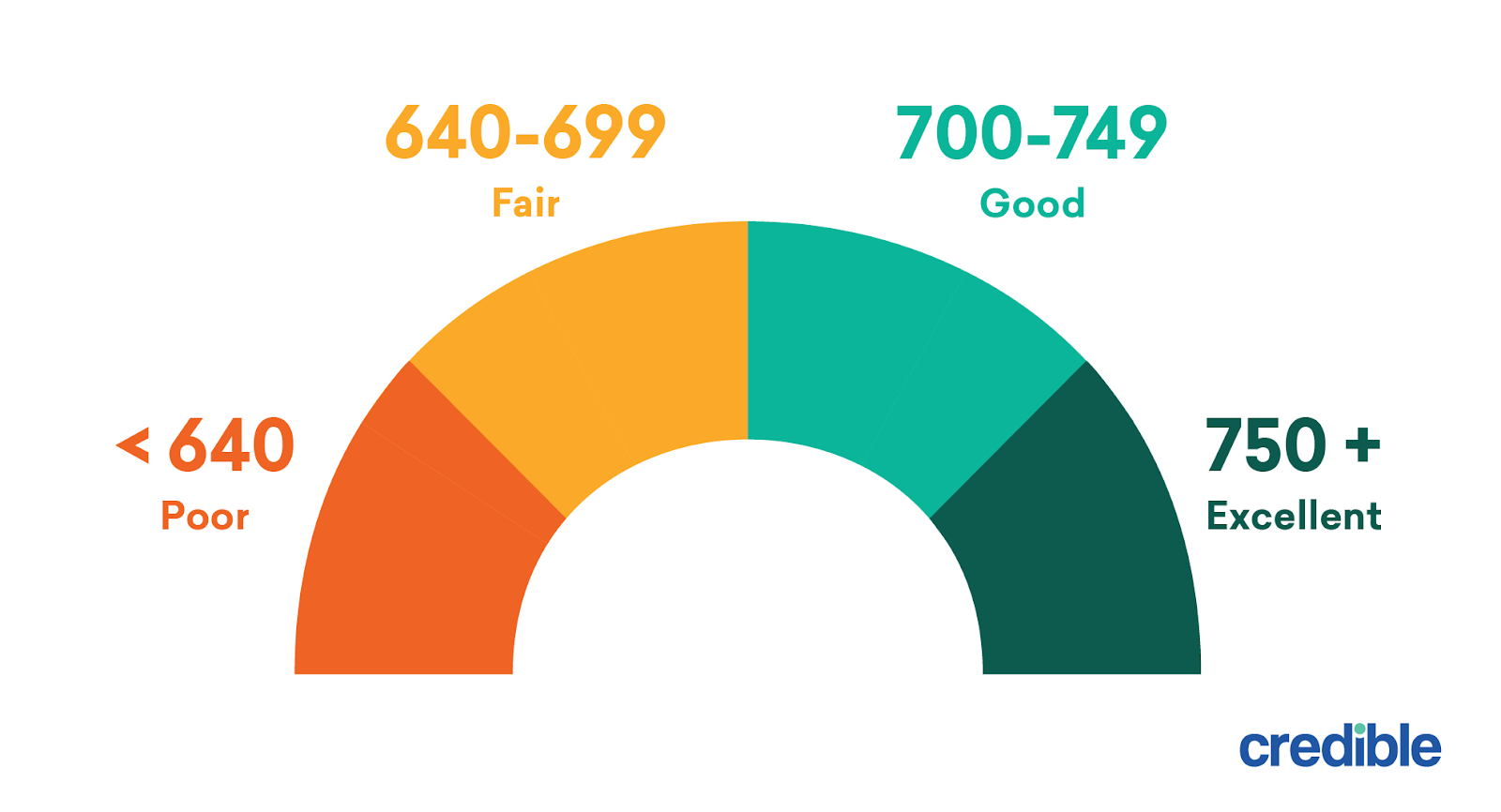

How do you know if your credit is bad? Once you know your score, see where it falls in the ranges below:

- Poor (less than 640): Lenders consider borrowers in this credit score range to be high risk. Having poor credit means you probably won't qualify for a conventional mortgage, but you might be able to get a government-backed home loan.

- Fair (640 to 699): Lenders see borrowers in this credit score range as less risky. You might have less debt or a stronger payment history than borrowers with poor credit. You can qualify for a conventional mortgage with fair credit, but you might need to be stronger in other areas to make up for it, and you could be saddled with a higher mortgage rate.

- Good (700 to 749): With good credit, you'll have a much easier time qualifying for a mortgage and getting a low interest rate. You'll probably secure offers from more than one lender.

- Excellent (750 and above): An excellent credit score demonstrates your ability to manage debt. You consistently make your payments on time and don't use too much of your available credit. Combined with a steady income, you'll qualify for a mortgage from multiple lenders and have the luxury of choosing the least expensive option.

While potential borrowers with poor credit will find it challenging to get a home loan, it can be done. You just need to learn about the options available and how lenders will look at your application.

Find Out: 800 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

Credit score needed to get a mortgage

While your credit score is an important factor in your home loan eligibility, it's not the only one. Here's what else lenders care about:

- Down payment: Depending on the loan and the lender, you'll need a minimum of 0% to 5% down.

- Debt-to-income ratio: Typically, you want a debt-to-income ratio of 36% or less when applying for a mortgage. In most instances, it can't total more than 45% to 50% of your income.

- Cash reserves: You might need up to six months' worth of mortgage payments in the bank with a low credit score and/or low down payment.

Minimum credit score by loan type

| Loan type | | Min. credit score |

|---|---|---|

| Conventional | A home loan not insured by the federal government | 620 |

| FHA | Government-insured mortgage for borrowers with low credit scores | 580 (with 3.5% down; 500 with 10% down) |

| VA | Government-backed mortgage for military service members (including qualified reservists) who meet length and character of service requirements, and their unmarried surviving spouses | None (though individual lenders might impose limits) |

| USDA | Government-insured home loan for low- and very-low-income applicants in eligible rural areas | None |

Keep Reading: 640 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

What having bad credit means for your mortgage rate

The lower your credit score, the higher your mortgage rate, all else being equal. If you have poor credit, expect to pay at least 1.5% more than someone with excellent credit.

The result will be a higher monthly mortgage payment and a higher long-term borrowing cost.

Assuming you're able to secure a loan with bad credit, you won't necessarily be stuck with the same rate forever. It might be possible to refinance to a better rate after improving your credit score.

Keep in mind: You'll have to pay closing costs when you refinance, and if market rates increase, having a higher score might not actually translate to a lower rate.

It's safer to only take on a mortgage now if you feel confident you can afford it long term, even if you hope to refinance or sell your home in a few years.

Learn More: What Is a Mortgage Rate and How Do They Work?

How to get a mortgage with bad credit

You might already be able to get a mortgage despite your bad credit. For example, if your score is at least 580, you can put down just 3.5% and get an FHA loan.

However, working to improve your score and other aspects of your finances gives you more options and can save you money. Follow the steps below to increase your chances of getting a mortgage:

1. Keep an eye on your credit

It's never been easier to get a free copy of your credit report. You can receive a free copy of your credit report from each of the three national credit reporting agencies at AnnualCreditReport.com.

Tip: Some sites make it look like you need to pay for your report. You don't. The three national credit bureaus — Equifax, Experian, and TransUnion — are required by federal law to provide you with a free annual credit report.

Analyze your reports to make sure all the information is accurate. If you find a mistake that could be weighing down your score, dispute it with the credit bureau or with the company that reported the incorrect data.

Check your score weekly as well. This allows you to see how your financial activity is affecting your score. If it's moving in the wrong direction, frequent checks will help you take quick corrective action.

2. Pay your bills on time

Payment history is the most important factor that determines your credit score, making up about 35% of it.

Make sure all your credit card, auto loan, and other debt payments post to your account by the due date to boost this part of your score.

Find Out: 700 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

3. Work on paying down debt

How much you owe makes up 30% of your credit score. Specifically, your credit score evaluates your balance relative to your available credit, often referred to as your credit utilization ratio. The lower that ratio, the better.

For example, your score will look better if your balance on a $5,000 credit line is $500 (10% utilization) instead of $2,500 (50% utilization).

If you rack up a high credit card balance one month, try to pay it down before your next statement is issued to keep your credit utilization down on your credit report.

Tip: If you're looking to improve your credit score, it's important that you use at least some of your available credit. Low credit utilization impacts your score more positively than 0% utilization.

4. Stay away from hard credit inquiries

Applying for a loan or credit card will usually ding your credit score if the creditor conducts a hard credit inquiry.

Credible lets prospective homebuyers shop for rates without impacting their credit scores. We'll show you actual, prequalified rates from our partner lenders — our process is secure and simple, and it only takes a few minutes to complete.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Find Rates Now

Opening a new account — or closing an old one — will also decrease the average age of your accounts, a factor that accounts for 15% of your credit score.

There are situations, however, where the benefit of applying for new credit might outweigh the impact on your credit score.

One example of this is transferring high-interest debt to a lower-interest card, which could help you pay down debt faster.

5. Consider a rapid rescore

If you're in a hurry to boost your credit score, a rapid rescore might help. Normally, your credit report and score get updated each billing cycle.

This means that after you pay down a credit card balance, for example, your new credit utilization rate might not be reflected in your score for up to a month.

Rapid rescoring can speed up the change to your credit score. Your lender might recommend it if you're close to having a good enough score to qualify for a loan or better rate.

Tip: Only your lender can request a rapid rescore; you can't do it yourself.

Keep Reading: Credit Score Needed to Get a Home Loan

6. Save up for a larger down payment

A larger down payment gives you more skin in the game, which makes you look less risky to lenders. It also means you won't need to borrow as much.

If your income is too high to qualify for other low-credit-score conventional loan programs such as Fannie Mae's HomeReady, you may still qualify for a conventional loan with a credit score of 620. You'll need to put 25% down and your debt-to-income ratio must be 36% or less.

In this case, you won't have to pay for private mortgage insurance. Your monthly mortgage payment will be smaller and your long-term interest expense will be lower. So, while you'll pay more up front, you'll pay less each month and over time.

7. Bring on a co-signer

A co-signer whose credit is better than yours could help you get approved for a mortgage or lower interest rate.

However, they will be taking on a huge responsibility: the obligation to pay your mortgage payments if you default. If they can't, their credit score will be impacted.

In other words, a co-signer must put their savings and their credit reputation at risk to help you. That's a big ask.

8. Consider a loan type with less stringent credit requirements

As we've noted, FHA loans have low credit score requirements. VA loans and USDA loans technically don't have a minimum credit score requirement. However, these two loan types do have stricter eligibility requirements:

- VA loans: Only available to military service members who meet length and character of service requirements, and their unmarried surviving spouses

- USDA loans: Only available to low- and very-low-income applicants in eligible rural areas

9. Shop around to find the best offer

Even with poor credit, you should shop around to find a great mortgage rate. With Credible, you can check prequalified rates from multiple lenders for free, all on one platform.

You might be eligible for better rates than you think. And if you're not, you now know the steps to get your score into better shape.

Get started today by checking out the table below, and see what rates you prequalify for from our partner lenders.

About the author

Amy Fontinelle

Amy Fontinelle is a mortgage and credit card authority and a contributor to Credible. Her work has appeared in Forbes Advisor, The Motley Fool, Investopedia, International Business Times, MassMutual, and more.

Read More

How To Get A House Loan With Bad Credit

Source: https://www.credible.com/blog/mortgages/buy-a-house-with-bad-credit/

Posted by: davisspont1970.blogspot.com

0 Response to "How To Get A House Loan With Bad Credit"

Post a Comment